As complex system science has shown with many examples (climate change, meteorology, cosmology, city dynamics, complex networks, etc.), the emergence of complex phenomena, such as synergy, is the product of interactions of many elements. Here, a deeper analysis of the working of synergy in market economies is presented, using experiments with computer simulations written in different languages (C#, Visual Basic 6, and JavaScript) that improved the robustness of my previous findings and provided more details of the economic mechanisms that trigger synergy. Its potential in visualizing fundamental concept in very simple economies will be explored here so as to avoid the limits “of ascertaining all the data whose utilization in the allocation of resources is the great merit of the market system” (Hayek 1911), and which are not easy to determine analytically in more complex economic settings. Agent based simulations are a powerful tool in clarifying fundamental aspects of the working of complex economic phenomena. However, agent based simulations have not been incorporated in mainstream economics, nor have they unveiled until now in detail the working of the invisible hand of the markets. Examples include the complexity of exchanges and money dynamics and banking catastrophes.

These modern computer simulations, specifically agent based simulations, allow us to explore complex economic phenomena. More recently, research on virtual artificial societies or computer simulations of social dynamics (see reviews in for example) have shown their worth in illuminating how the aggregate of various simple interactions might produce phase transitions and the emergence of novel properties of the system and even novel phenomena.

This was the work by Carter entitled “In search of synergy: A structure-performance test.” Here, Carter wrote that “the possibility of synergistic effects to diversification is recognized by most if not all observers.” So evident is the importance of synergy to economists that few write about it. This last search showed the paper by Marris and Mueller, review of the literature entitled “The Corporation, Competition and the Invisible Hand” where the word synergy appears only in the title of one of the papers in the 5 pages of references. A Google Scholar search () of the terms “synergy” and “economics” revealed 216000 results of “synergy” and “mergers” 37300 of “synergy” and “Adam Smith” 12700 of “synergy” and “invisible hand” 6610 of “synergy,” “invisible hand,” and “simulation” 1540. In modern economics, the term is widely used. Exploring “Google Books Ngram Viewer” for the word “synergy,” ranging the years 1800 to 2000, shows that the use of the word synergy starts after the year 1900.

The concept was further developed as a process involved in self-organization by the theoretical physicist Haken and the biologist Corning. The term synergy in science was used in neuromuscular physiology by Sherrington when he described the integrative action of the nervous system. This insight, although trivial if viewed a posteriori, improves our understanding of the source and nature of synergies in real economic markets and might render economic and natural sciences more consilient. These features allow for social processes that increase the information available and increase simultaneously the capacity of producing useful economic work, that is, synergy. The larger the contact horizon between participants of the market is, the more efficient the market forces act. Markets help synchronize agent’s actions.

These are heterogeneity or spatial or temporal heterogeneous environment and/or agents complementary activities of agents, with divergent optimization options and synchrony. By visualizing the detailed dynamics underlying this phenomenon in a simple virtual economy, the elements underpinning the synergistic effect on economic output produced by the division of labor between agents could be dissected. Simulations with Sociodynamica allowed the emergence of market forces in virtual economies, showing that the synergistic working of division of labor in complex settings favors a stable state where all actors benefit (win-win interaction).

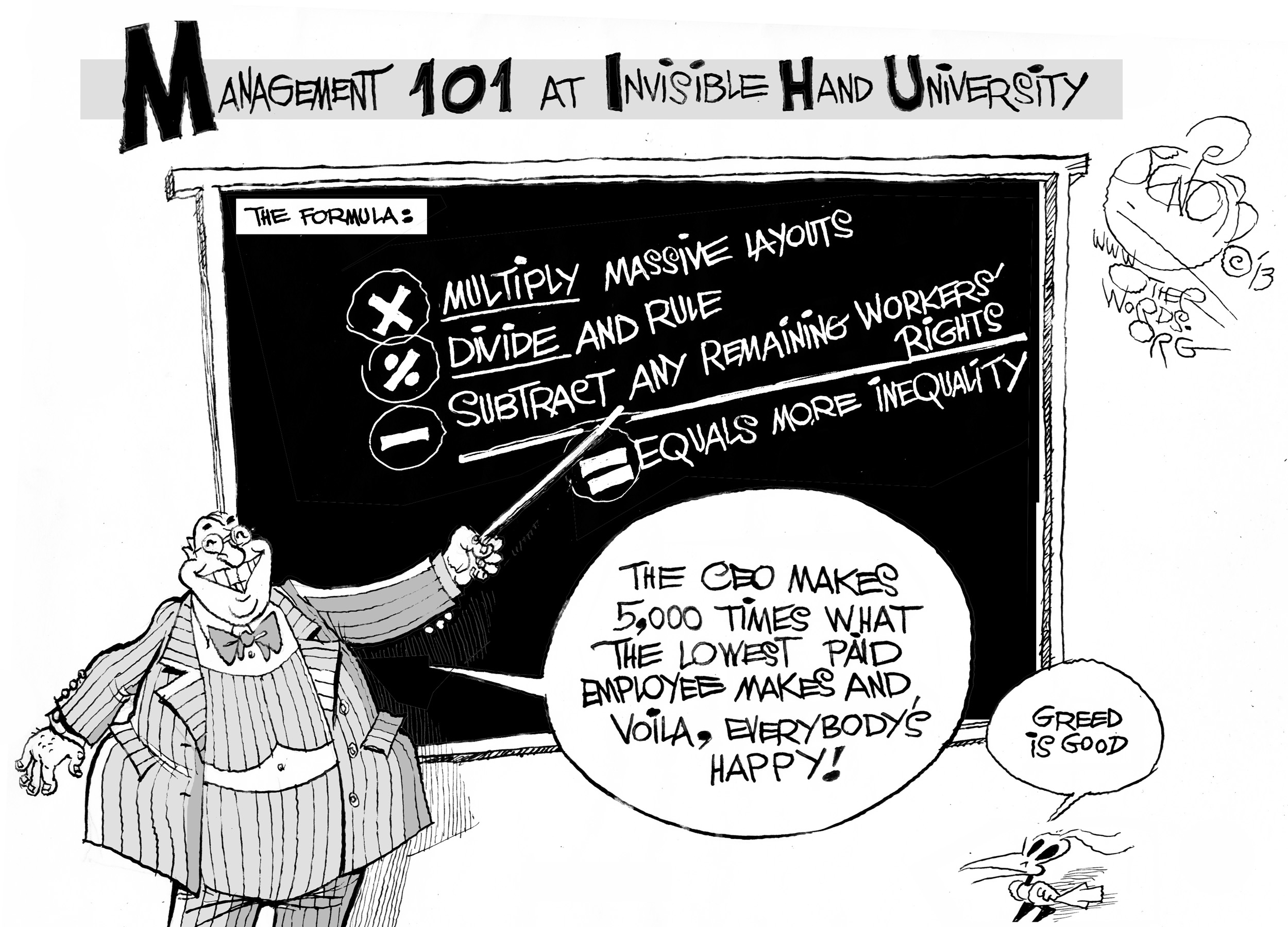

#Ivisible han free

Inspired by Adam Smith and Friedrich Hayek, economists promoting free markets postulate the existence of invisible forces that drive economic growth.

0 kommentar(er)

0 kommentar(er)